¿Podrás Resistirte a la Nueva Invasión Tecnológica de Xiaomi en España? 📺🚀 Las Nuevas Smart TV de Xiaomi Prometen Revolucionar el Mercado Español con Precios Insuperables ¿Estás Listo para la Última Sensación en Televisores? ¿Quién dijo que la alta tecnología tenía que ser inaccesible? Xiaomi vuelve a desafiar los límites

CONTINUAR...Innovar con los bocadillos y triunfar con un delivery Los bocadillos forman parte de la tradición culinaria española. Este tentempié, que habitualmente

MoreProgramas de bienestar conquistan la pantalla televisiva La televisión, como medio de comunicación masivo, ha desempeñado un papel crucial en la vida

MoreAutomatización Universal – Tendencias en el sector industrial: El Futuro Software-Céntrico de la Industria. Buenos días, soy Johnny Zuri y HOY quiero

More¿Cómo revoluciona “Palm Royale” el vestuario vintage con un toque moderno? 🌟 Descubre “Palm Royale”: Un espectáculo de moda vintage con Kristen

More¡Habla, no escribas! La revolución de la búsqueda por voz en el marketing digital 🗣️🔍 ¡Adiós a teclear! Cómo la búsqueda por

MoreEl Futuro Ya Está Aquí: Los Chips Cerebrales de Neuralink Transforman la Ficción en Realidad 🧠💡 Chips Neuralink: Fusión Humano-A.I., Avances Médicos

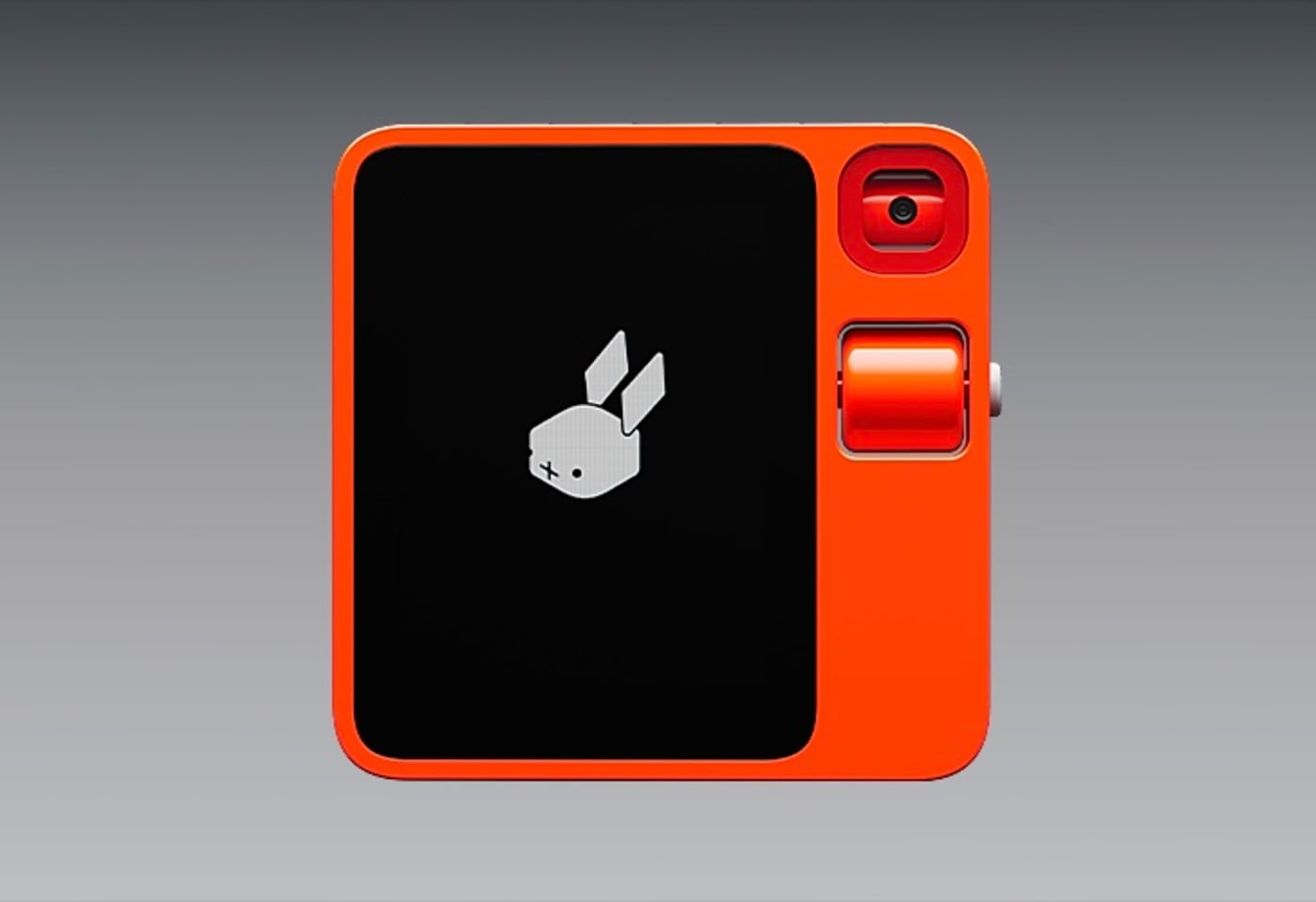

MoreEl Conejito Naranja Conquista el mundo: La Fiebre del Rabbit R1 🚀🐰 AI y Tecnología Futurista 🐰🚀 En un despliegue de ingenio

More¿Es “El problema de los tres cuerpos” el Último Vicio de Ciencia Ficción en Netflix? ¡Descúbrelo! 🚀”El problema de los tres cuerpos”

More5 utensilios que no pueden faltar en una cocina El menaje del hogar está más de moda que nunca. Más allá de

MoreBig data en redes sociales: Técnicas para manejar grandes volúmenes de datos 🌊📊 Big Data y redes 🚀📈 En el vertiginoso mundo

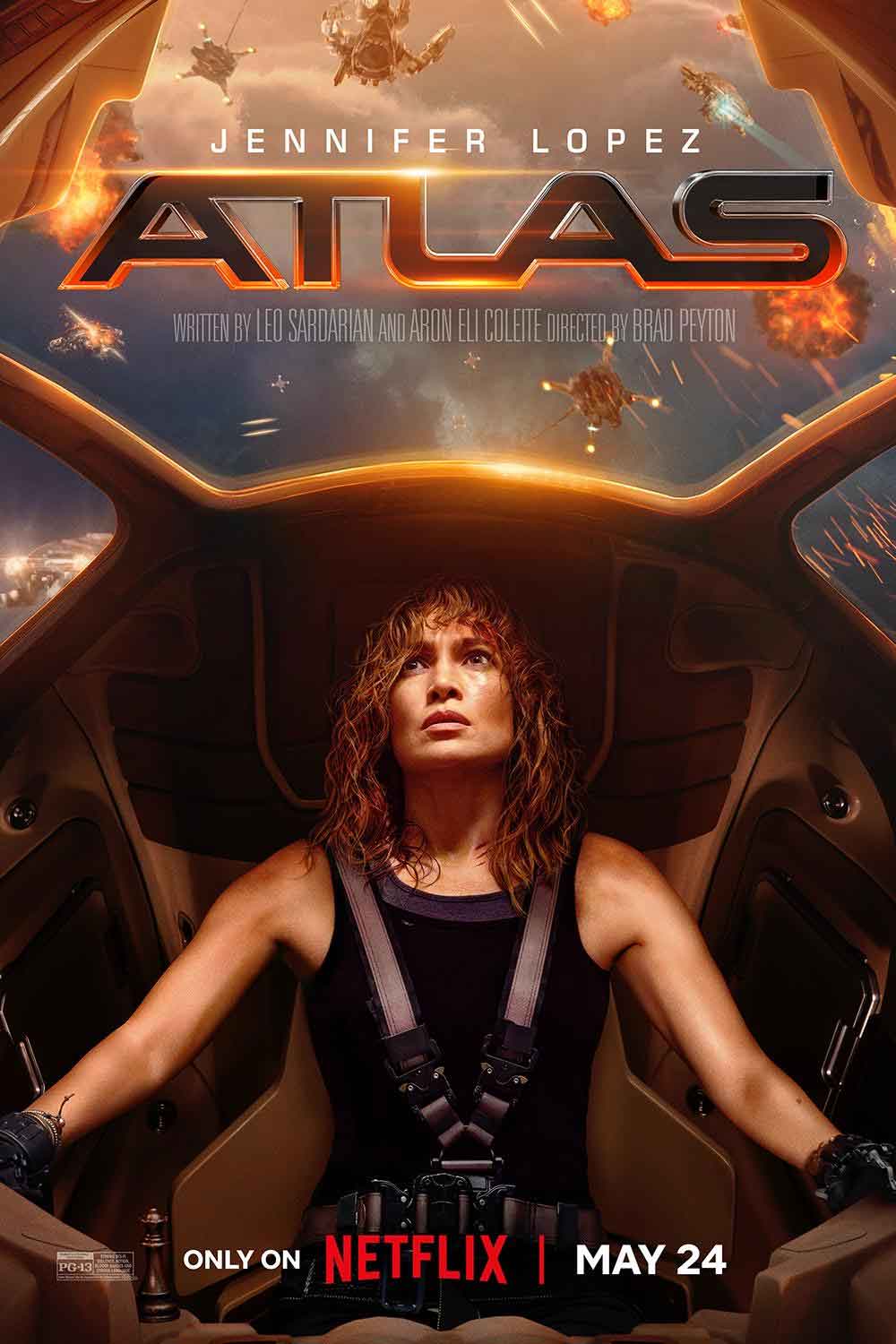

MoreENTREVISTA: “El futuro cinematográfico según Atlas, la ciencia ficción y Jennifer Lopez” Desvelando los misterios detrás de Atlas: Jennifer Lopez contra robots

MoreLa Red Burocrática Retro: Cómo Sobrevivir a la Máquina del Tiempo Administrativa. En el intrincado mundo de la burocracia, un término que

MoreSostenibilidad sobre ruedas: el auge de los coches usados La adquisición de coches usados ha ganado popularidad en los últimos años, ofreciendo

More¿Sex-shop, tienda erótica, tuppersex o bien dropshipping? SERVICIOS DROPSHIPPING – Que son – Cómo funcionan – Cuanto hay que invertir… Imagina montar

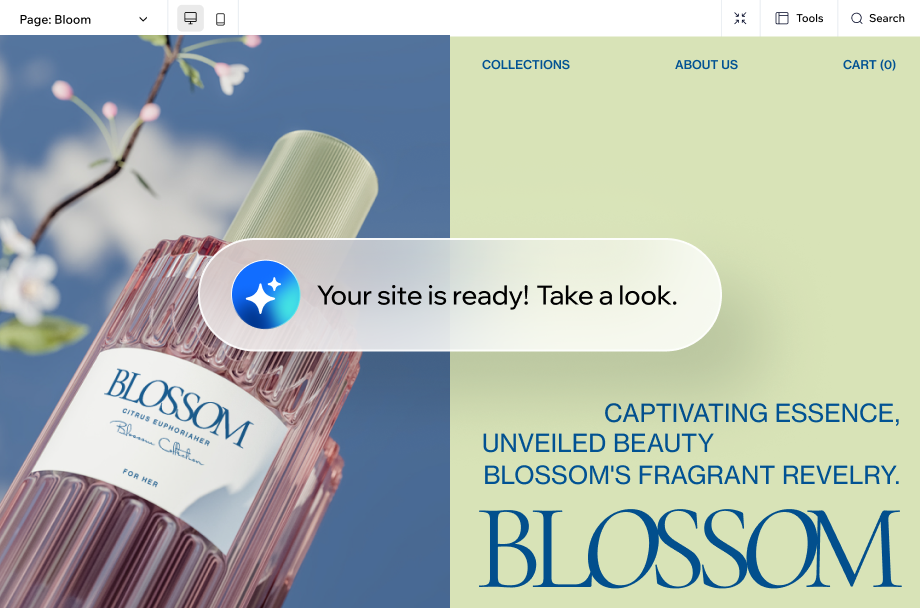

MoreCómo diseñar una web con IA en 2024: La Revolución Futurista del Diseño Web 🤖✨ Descubre la revolución futurista en el diseño

MoreEstas son las Aplicaciones Deportivas Que Te Harán Olvidar el Gimnasio: ¡Ponte en Forma Desde Tu Sofá! En un mundo donde la

MoreHP OMEN 34c: El Monitor Gaming Futurista que Parece Sacado de una Película de Ciencia Ficción. HP OMEN 34c: El Monitor Gaming

MoreHackers, votos y videotapes: La historia no contada de los ataques cibernéticos a los sistemas electorales estadounidenses. Descubriendo los Ataques Cibernéticos en

MoreTelevisores Antiguos y la Magia del Pasado: Un Viaje por la Historia de la TV 📺✨ La Fascinante Evolución de los Televisores:

More¿Un servicio técnico oficial de instalaciones Bang & Olufsen? Cómo instalar bang & olufsen en tu comunidad de vecinos inteligente. Dantec es

MoreDescubrimos las novedades dentales y tecnología. Tecnología de RV en tratamientos dentales inteligentes. La odontología está viviendo un cambio radical con la

MoreLas mejores webs de juegos y la cultura del entretenimiento digital: Un análisis profundo. En el vasto universo del entretenimiento digital, los

MoreAvances Robóticos y Tecnológicos: de Neuralink a Cocinas Autónomas Neuralink Implanta su Primer Chip en un Voluntario La empresa Neuralink, liderada por

MoreRobot Ballie: La Innovación en Asistentes Personales del Hogar Introducción a Ballie – Un Nuevo Compañero en el Hogar. En el mundo

MoreNuevas Tecnologías en la Administración: Una Revolución Inminente” 🚀💡🌐 Últimas Innovaciones 🌟🔍👩💼. El año 2024 se está configurando como un período de

MoreAudio-Technica ATH-TWX7: ¿los auriculares con cancelación de ruido de 190€ que pueden destronar a Sony? Audio-Technica ha presentado sus nuevos auriculares verdaderamente

More